Thinking About Retiring Soon? Here’s How to Make the Most of Your Final Year at Work If you’re 6 to 12 months away from retirement, this is your window to get strategic. Not just with your money—but with your mindset, your goals, and your game plan. Many people enter retirement thinking it’s all about numbers: […]

Do I Need an Umbrella Policy?

Umbrella Insurance for Retirees This is a question we hear often — especially from retirees who’ve worked hard to build a nest egg. That nest egg might include your home, car, or boat — all covered by property and casualty (P&C) insurance — as well as liquid assets like IRAs, 401(k)s, brokerage accounts, and HSAs. […]

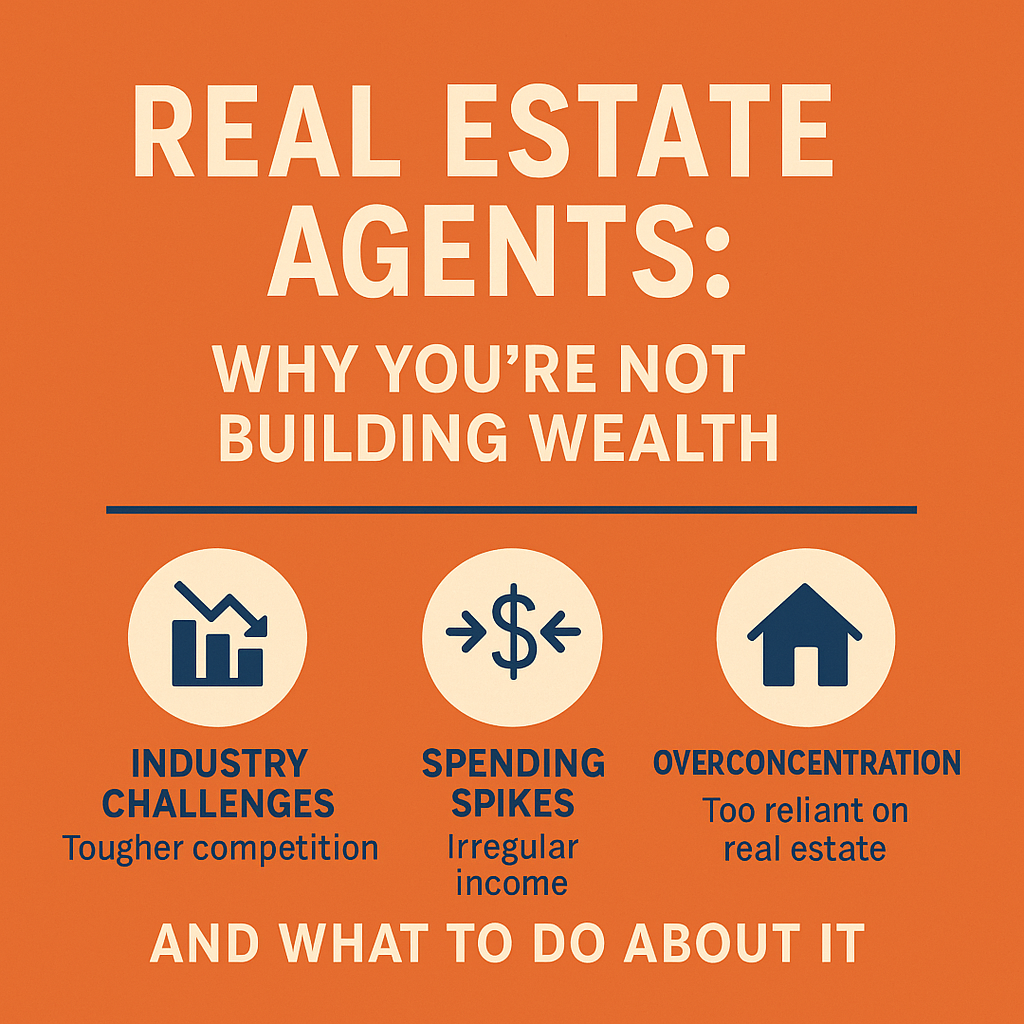

Real Estate Agents: Why You’re Not Building Wealth (and What to Do About It)

There’s nothing quite like the feeling of closing a deal. You’ve worked hard, stayed persistent, managed high-maintenance clients, and somehow kept the deal alive until signing day. The wire hits. The commission clears. For a brief moment, it feels like everything is worth it. But three months later, you’re back in the grind—and somehow, that […]

Biggest Estate Planning Mistakes (and How to Avoid Them)

Introduction: Avoiding Costly Estate Planning Mistakes Estate planning can feel overwhelming. Between the technical jargon and conflicting advice, it’s easy to make mistakes that could cost your loved ones time, money, and peace of mind. I see two main types of mistakes when it comes to estate planning: not planning at all and planning way […]

Why You Can’t Convert RMDs to Roth IRAs — And What to Do

For many people approaching retirement, Roth conversions feel like a no-brainer. They’ve heard the concept from friends, online forums, or financial podcasts: convert pre-tax retirement dollars to a Roth IRA, pay taxes now, and enjoy tax-free growth forever. Sounds great, right?

Can I Retire Yet? A Practical Approach to Deciding

A Straightforward Starting Point for a Life-Changing Decision After working with hundreds of clients over the years, I’ve found one question consistently rises to the surface: “How do I know if I can afford to retire?” It’s one of the most important financial questions any of us will face. But most people don’t want to […]

How to Assess an Advisor’s Fee (Are You Getting Your Money’s Worth?)

As quoted in ComparisonAdviser’s article titled “Is a 1% Financial Advisor Fee Worth It?” Hiring a financial advisor is one of the most important financial decisions you’ll make. And let’s be honest — it’s not cheap. If you’re like most people, you’ve probably wondered at some point: “What am I actually getting for this fee?” […]

4 Costly Long-Term Care Insurance Mistakes to Avoid

Long-term care insurance (LTCi) was supposed to be the answer—an insurance solution to protect retirees and their families from the crushing costs of extended care. But as policyholders are now discovering, it’s not that simple. Too many people make critical mistakes with their LTC policies—mistakes that can cost tens, if not hundreds, of thousands of […]

Should You Keep That Rental?

A Financial Advisor’s Perspective on Rental Property Financial Planning If you’re anything like our clients—you’ve probably had moments where real estate investments leave you scratching your head. From a pure numbers perspective, they often don’t look as great as traditional portfolios. But peel back a few layers, and there’s a lot more to the story. […]

Here’s Why We’re Grateful We Stepped Away from Stocks a Month Ago

When evaluating potential agencies, consider their expertise in various aspects of branding and design.